In this Article:

- What are bottom-up economic policies, and why do they matter?

- How has GDP and job growth differed between parties?

- Does trickle-down economics truly benefit the middle class?

- Why does Trump’s economic impact fall short?

- How do bottom-up policies foster equity and stability?

Reagan Style Economics: What the Data Shows

by Robert Jennings, InnerSelf.com

It started innocently enough—two neighbors, separated by a fence, connecting for the first time in nearly 40 years. And, as so often happens these days, the conversation shifted to politics and, inevitably, the economy. My neighbor, a devoted Fox News viewer, confidently declared, "The economy was so much better under Trump." I paused, realizing we were wading into murky waters. For me, politics is secondary; my concern lies in economic policies and their real-world impact on the working class—a perspective I call true populism.

Our chat got me thinking: Why do so many Americans believe Republican presidents are better at managing the economy when the data shows otherwise? This article is not about assigning blame or picking sides; it's about understanding why bottom-up economic policies, often championed by Democratic administrations, consistently outperform the top-down strategies favored by their Republican counterparts. So let's dive into the numbers, the narratives, and the undeniable benefits of building an economy from the ground up.

Bottom-Up vs. Top-Down Policies

Before we get into the stats, it's essential to understand what we mean by "bottom-up" and" "top-down" economics. Bottom-up policies prioritize the average worker and the everyday American. They focus on investing in education, healthcare, infrastructure, and programs that lift the middle and lower classes. Think of initiatives like Social Security, Medicare, and affordable housing projects.

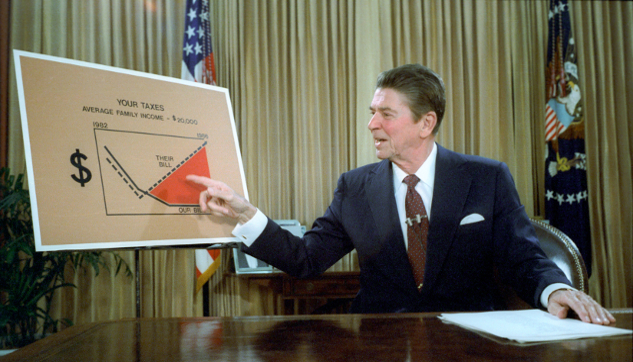

In contrast, top-down economics relies on the trickle-down theory. The idea is simple: Cut taxes for the wealthy and large corporations, reduce regulations, and the benefits will eventually "trickle down" to the rest of society. It's an appealing theory, especially if you're at the top of the economic ladder. But the reality has rarely lived up to the promise, as we'll see in the data.

What the Data Shows

When it comes to GDP growth, the numbers speak volumes. Since 1913, Democratic presidents have overseen an average annual GDP growth of 4.6%, compared to just 2.4% under Republican presidents. This is a clear testament to the effectiveness of Democratic policies like FDR's New Deal and Lyndon B. Johnson's Great Society programs, which injected money into the economy through public works and social programs, spurring growth that benefited everyone—not just the wealthy.

The data is equally compelling when it comes to job creation. Historically, Democratic administrations have consistently outpaced their Republican counterparts in generating jobs. During Bill Clinton’s presidency alone, 22.7 million jobs were created, driven by strategic investments in technology and infrastructure. In contrast, Republican policies often prioritize corporate profits over workforce expansion, resulting in slower job growth and fewer opportunities for the middle class.

Many assume Republicans are better for investors, but the stock market tells a different story. Democratic presidencies have often delivered higher returns. For instance, during Barack Obama's term, the Dow Jones Industrial Average increased by 148%, recovering from the Great Recession and setting the stage for sustained growth. Under Trump, the market saw gains. However, much was built on pre-existing momentum and fueled by corporate tax cuts that ballooned the deficit.

If there's an area where the contrast between these two approaches is most stark, it's inequality. Top-down policies exacerbate the wealth gap by disproportionately benefiting the rich. Meanwhile, Democratic efforts to raise the minimum wage, expand access to healthcare, and invest in education have consistently helped narrow the gap. It's evidence that periods of reduced inequality have aligned with bottom-up economic strategies.

Economies thrive when people have money to spend. Bottom-up policies prioritize putting cash in the hands of average Americans, who are far more likely to spend it on goods and services, fueling demand and driving economic growth. Programs like unemployment benefits, stimulus checks, and affordable healthcare are not just safety nets—they're economic engines.

A more equitable economy is a more stable economy. Bottom-up policies reduce the wealth gap, ensuring that prosperity is broadly shared. When the middle class grows, so does the entire economy. Conversely, top-down policies concentrate wealth at the top, leaving the majority struggling to make ends meet.

History has shown us that bottom-up strategies are particularly effective during crises. During the Great Depression, FDR's Deal created jobs, rebuilt infrastructure, and restored confidence. Decades later, Obama'sObama'smulus package and healthcare reforms helped pull the country out of the Great Recession, setting the stage for years of sustained growth.

The Emotional Appeal of Top-Down Policies

Despite its lackluster track record, trickle-down economics remains popular. Why? Its simplicity and surface logic make it appealing. The notion that cutting taxes will automatically spur economic growth seems plausible, even if history shows otherwise. Adding to its allure is the messaging. Republicans have masterfully branded themselves as champions of "tax relief," tapping into voters' frustrations about feeling overburdened by taxes, even when those cuts primarily benefit the wealthiest.

Conservative media outlets amplify these narratives, often portraying Democrats as reckless spenders who prioritize handouts over hard work. This messaging reinforces biases and overshadows the economic gains achieved under Democratic policies. Meanwhile, successes like Biden's Infrastructure bill or Obama's Affordable Care Act are downplayed or criticized.

Let's get back to that conversation with my neighbor. As we stood by the fence, discussing everything from inflation to job growth, I realized something: His beliefs were in data, shaped by decades of narratives and soundbites. I shared a few stats with him—about GDP growth, job creation, and even the stock market—and saw a flicker of curiosity. "I didn't know that," he admitted. It was a powerful reminder that while changing minds isn't easy, it's possible with honest, respectful conversations. This should give us all hope for a more informed and united future.

The 2024 U.S. presidential election is the most expensive in history, with total spending projected to reach approximately $15.9 billion, surpassing the previous record of $15.1 billion set in 2020. A significant portion of this expenditure occurred in the final three months leading up to Election Day, marked by intensified campaigning and advertising efforts.

Tech billionaire Elon Musk became a prominent contributor during this election cycle, donating at least $250 million to support President-elect Donald Trump and other Republican candidates.

Musk's financial involvement included substantial contributions to America PAC, a pro-Trump super PAC he founded and funded exclusively. In addition to Musk, other billionaires and affluent donors significantly influenced the election's financial landscape, particularly in the final weeks.

Their contributions were often channeled through super PACs and dark money networks, facilitating large-scale media advertising campaigns concentrated in battleground states. This influx of funds aimed to sway undecided voters and bolster support for preferred candidates.

Substantial financial investments in the 2024 election underscore the growing influence of wealthy individuals in American politics. The concentration of spending in the election months highlights the strategic importance of last-minute advertising and outreach efforts in determining electoral outcomes.

There is a growing perception that billionaires wield significant influence over American elections, and the 2024 presidential race, along with earlier examples like Peter Thiel's support for J.D. Vance in Ohio, reinforces this narrative. In the 2024 election, major donors, including Elon Musk, reportedly spent hundreds of millions of dollars, mainly through super PACs and targeted media campaigns, to sway key battleground states favoring Donald Trump. This echoes Thiel's efforts to secure Vance's win in 2022 by heavily funding his campaign.

The concentration of wealth in politics raises concerns about democracy being shaped more by financial power than broad public support. With unrestricted contributions to super PACs and the use of dark money networks, billionaires' ability to flood elections with cash has shifted the balance of influence, making it difficult to argue that electoral outcomes are purely a reflection of voter sentiment. Instead, they increasingly appear to be the product of strategic, high-dollar investments by a few wealthy individuals.

The Biden Economy vs. Global Reality

The Biden administration left a legacy of resilience and recovery in the U.S. economy, charting a path through post-pandemic challenges that outpaced much of the world. While global inflation surged, the United States stabilized rising prices through strategic fiscal and monetary policies, fostering a robust economic recovery. Job growth was steady and strong, GDP climbed consistently, and significant infrastructure and clean energy investments set the stage for long-term economic competitiveness. These achievements underscored a transformative approach to financial management rooted in bottom-up principles that focused on empowering workers and rebuilding the middle class.

Key legislation under Biden, such as the Infrastructure Investment and Jobs Act, played a pivotal role in this economic turnaround. The $1.2 trillion law funneled investments into critical areas like roads, bridges, broadband, and public transit, creating jobs across industries and bolstering connectivity for small businesses and underserved communities. Unlike top-down approaches prioritizing corporate interests, this initiative spread its benefits widely, revitalizing rural and overlooked regions that had long been excluded from national prosperity. The Biden administration redefined the framework for inclusive growth by empowering local economies.

The Inflation Reduction Act (IRA) expanded on these principles, head-on targeting climate and affordability challenges. With over $370 billion allocated to clean energy, the IRA fueled the development of renewable industries like solar, wind, and battery manufacturing, creating jobs while addressing the climate crisis. Simultaneously, its provisions to lower healthcare and prescription drug costs directly alleviated financial pressures on millions of families. This dual focus on sustainability and household affordability demonstrated the administration of policies prioritizing everyday people's needs over corporate profits.

While these achievements laid the groundwork for a more equitable and sustainable future, their full impact may not have been immediately apparent to the public. Lingering pandemic scars, rising housing costs, and misinformation in partisan media skewed perceptions of the economy, undermining confidence in the administration's administration's accomplishments. However, history will likely recognize the Biden administration as a turning point in economic leadership that shifted the focus from trickle-down economics to a people-driven approach that fostered resilience, equity, and a forward-looking vision for the nation.

The Trump Threat to Bottom-Up Economics

The prospect of another Trump administration poses significant threats to the progress made under bottom-up economic policies, as his proposed measures prioritize populist appeal over practical solutions. Trump's rhetoric often exploits economic dissatisfaction, resonating emotionally with voters frustrated by perceived injustices. However, his policy proposals, such as imposing broad tariffs and mass deportations, present severe risks to economic stability and the middle-class workers he claims to support.

Broad tariffs, a signature element of Trump's Presidential agenda, may seem like a strong stance against unfair trade practices. Still, their implementation would raise consumer prices across the board. These tariffs would disrupt global supply chains, impacting everything from manufacturing to retail. American exporters would face retaliatory measures from trading partners, shrinking their markets and diminishing competitiveness. The middle class, already burdened by inflation and stagnant wages, would bear the brunt of these rising costs, exacerbating the economic struggles they hoped Trump's policies would alleviate.

The mass deportation of up to 11 million undocumented immigrants is another proposed measure fraught with economic peril. Undocumented workers play critical roles in industries such as agriculture, construction, and hospitality—sectors already grappling with labor shortages. Their removal would disrupt production, drive up costs, and destabilize local economies that rely on their contributions. Communities would face significant social and economic upheaval. At the same time, tiny enterprises would struggle to adapt to these sweeping changes.

Beyond these immediate risks, a Trump administration's roach would undermine the principles of bottom-up economics, shifting the focus back to top-down strategies prioritizing corporate profits and tax cuts for the wealthy. His proposed policies risk increasing inequality, dismantling community-driven growth, and destabilizing industries crucial to the nation's economic fabric. For voters concerned with sustainable prosperity and equitable opportunity, these threats underscore the importance of preserving and expanding the groundwork laid by a bottom-up approach.

Choosing a Path Forward

Decades of economic debate reveal one undeniable truth: the choice between bottom-up and top-down policies is not just a matter of ideology—it determines the trajectory of millions of lives. Bottom-up strategies, focused on investing in the middle class, education, and infrastructure, have repeatedly proven to drive sustainable growth and shared prosperity. By addressing systemic inequities and empowering communities, these policies create the foundation for a more resilient and inclusive economy, benefiting society as a whole.

In contrast, top-down approaches, often rooted in the allure of tax cuts and deregulation, have repeatedly widened the wealth gap, destabilized industries, and left working families struggling. The emotional appeal of such strategies may resonate with voters seeking simple solutions, but history shows that their promises often fail to materialize. As the country faces mounting challenges—from climate change to economic inequality—an overreliance on these outdated models would risk reversing the progress made and deepening the divides that threaten societal cohesion.

The legacy of the Biden administration serves as a reminder of what can be achieved when policy prioritizes people over profits. Its investments in clean energy, infrastructure, and healthcare were not just fiscal strategies but moral imperatives—proof that an economy built from the ground up can deliver prosperity for all. Meanwhile, the looming specter of another Trump presidency underscores the stakes, with proposals that could destabilize the middle class, erode workers' rights, and unravel the progress toward a fairer, more sustainable economic future.

Ultimately, the path forward demands a commitment to policies that lift everyone, not just those at the top. It requires informed choices, grounded in data and history, that prioritize collective well-being over short-term political wins. As voters and citizens, we hold the power to shape the economy we want—one that reflects the best of our values and aspirations, ensuring opportunity and stability for generations to come.

About the Author

Robert Jennings is the co-publisher of InnerSelf.com, a platform dedicated to empowering individuals and fostering a more connected, equitable world. A veteran of the U.S. Marine Corps and the U.S. Army, Robert draws on his diverse life experiences, from working in real estate and construction to building InnerSelf with his wife, Marie T. Russell, to bring a practical, grounded perspective to life’s challenges. Founded in 1996, InnerSelf.com shares insights to help people make informed, meaningful choices for themselves and the planet. More than 30 years later, InnerSelf continues to inspire clarity and empowerment.

Robert Jennings is the co-publisher of InnerSelf.com, a platform dedicated to empowering individuals and fostering a more connected, equitable world. A veteran of the U.S. Marine Corps and the U.S. Army, Robert draws on his diverse life experiences, from working in real estate and construction to building InnerSelf with his wife, Marie T. Russell, to bring a practical, grounded perspective to life’s challenges. Founded in 1996, InnerSelf.com shares insights to help people make informed, meaningful choices for themselves and the planet. More than 30 years later, InnerSelf continues to inspire clarity and empowerment.

Creative Commons 4.0

This article is licensed under a Creative Commons Attribution-Share Alike 4.0 License. Attribute the author Robert Jennings, InnerSelf.com. Link back to the article This article originally appeared on InnerSelf.com

books_economics

Article Recap

Bottom-up economic policies prioritize the middle class, fostering growth and equity. This article contrasts their success with the shortcomings of Trump’s economic impact, highlighting why bottom-up strategies create sustainable prosperity.

#BottomUpEconomics #EconomicGrowth #MiddleClassProsperity #TrickleDownEconomics #TrumpEconomicImpact #InequalitySolutions