In This Article

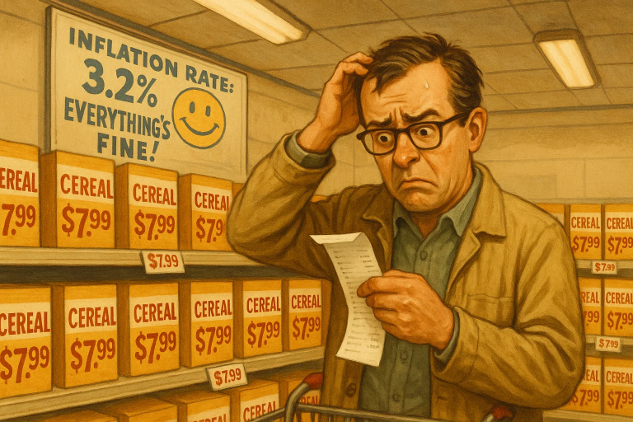

- Why inflation feels worse than the official number

- How current CPI methods mask real price hikes

- What tariffs and the removal of de minimis exemptions are hiding

- Why shrinkflation and substitution tricks deceive consumers

- How month-over-month data reveals the true cost pressure

- What all this means for trust in institutions and democracy

🔓

Continue Reading — Free Membership

InnerSelf is a community of real people — not bots, not algorithms.

Register free to read this article and access our full 25,000-article archive.

No credit card. No spam. Just InnerSelf.