Senator Bernie Sanders speaks passionately at a rally, championing healthcare as a universal right. His progressive agenda and grassroots support raise the question: Could Sanders' candidacy in 2016 have countered Trump's false populist appeal with his bold, inclusive vision for economic and social reform? This image symbolizes the ongoing struggle for equity for the working class in America.

In This Article:

- What are Medicare and Social Security, and why are they essential?

- How do past reforms reveal a pattern of targeting these programs?

- What is Project 2025, and how could it reshape these lifelines?

- Are Trump's promises of protection aligned with conservative policy blueprints?

- Why does rising inequality threaten the Social Security trust fund?

- What actions can you take to defend these earned benefits?

Protect Medicare and Social Security: The Battle Against Project 2025

by Robert Jennings, InnerSelf.com

Medicare and Social Security are not just government programs—they are promises, they are lifelines. These benefits are the cornerstone of financial security for millions of hardworking Americans who have contributed their share, trusted in the system, and now rely on these programs in their later years. Yet, this vital promise is under threat as political forces with their own agendas set their sights on these essential programs.

Donald Trump's vocal pledges to protect Medicare and Social Security gave many Americans a sense of relief. His promises of no cuts and even the elimination of taxes on Social Security income resonated with those who depend on these lifelines. However, behind the scenes, a much different agenda is unfolding. Project 2025, a conservative policy blueprint, reveals plans that could fundamentally alter or undermine these programs. This stark contrast between Trump's promises and the intentions of his political allies reveals a precarious situation for millions of Americans.

Republican Pattern of Targeting Benefits

Looking back, the Republican Party has often targeted Social Security and Medicare in the name of reform. Ronald Reagan's administration in the 1980s was a turning point. While touted as bipartisan solutions, the changes implemented under Reagan included raising the retirement age, slowing cost-of-living adjustments, and even taxing Social Security benefits for the first time. These reforms disproportionately impacted middle-income earners, leaving wealthier contributors largely untouched.

George W. Bush continued this trend in 2005, attempting to privatize Social Security by allowing individuals to invest in the stock market. The proposal was met with widespread opposition, as Americans feared the volatility of Wall Street and the erosion of their guaranteed benefits. The public backlash was so severe that the initiative was abandoned, and Bush's approval ratings suffered. Despite these setbacks, the Republican push to overhaul these programs has never disappeared. Instead, it has evolved and cloaked in procedural complexities and fiscal justifications.

The Present Threat: Project 2025 and Privatization

Fast-forward to today, Project 2025 emerges as a roadmap for conservative policy goals, including dramatic Medicare and Social Security changes. Unlike the blunt approaches of the past, this initiative relies on subtle but significant procedural tactics. Reconciliation—a legislative process that allows bills to pass with a simple majority in the Senate—could be used to push through changes with minimal public debate. The potential impact of these changes on Medicare and Social Security cannot be overstated, making awareness and advocacy essential to their protection.

Medicare, in particular, appears to be a primary target. Programs like Medicare Advantage, which already function as private alternatives, could see expanded roles under Project 2025. Critics argue that such moves undermine Medicare's foundational purpose as a public safety net, shifting profits to private corporations and leaving vulnerable populations at risk.

Trump's Promises vs. Project 2025: A Stark Contrast

Donald Trump consistently promised to protect Medicare and Social Security during his campaigns. His rhetoric centered on ensuring that these programs remained untouched, even proposing eliminating taxes on Social Security income. These assurances played a significant role in solidifying his support among seniors and working-class Americans.

However, Project 2025 tells a different story. Spearheaded by conservative think tanks, it outlines proposals that could erode these programs through increased privatization and backroom reforms. Privatization efforts, trust fund depletion to justify benefit cuts, and secretive commissions to fast-track changes starkly contrast Trump's campaign promises. This divergence highlights the tension between Trump's populist rhetoric and the broader Republican agenda.

The Looming Crisis: Rising Inequality and Trust Fund Depletion

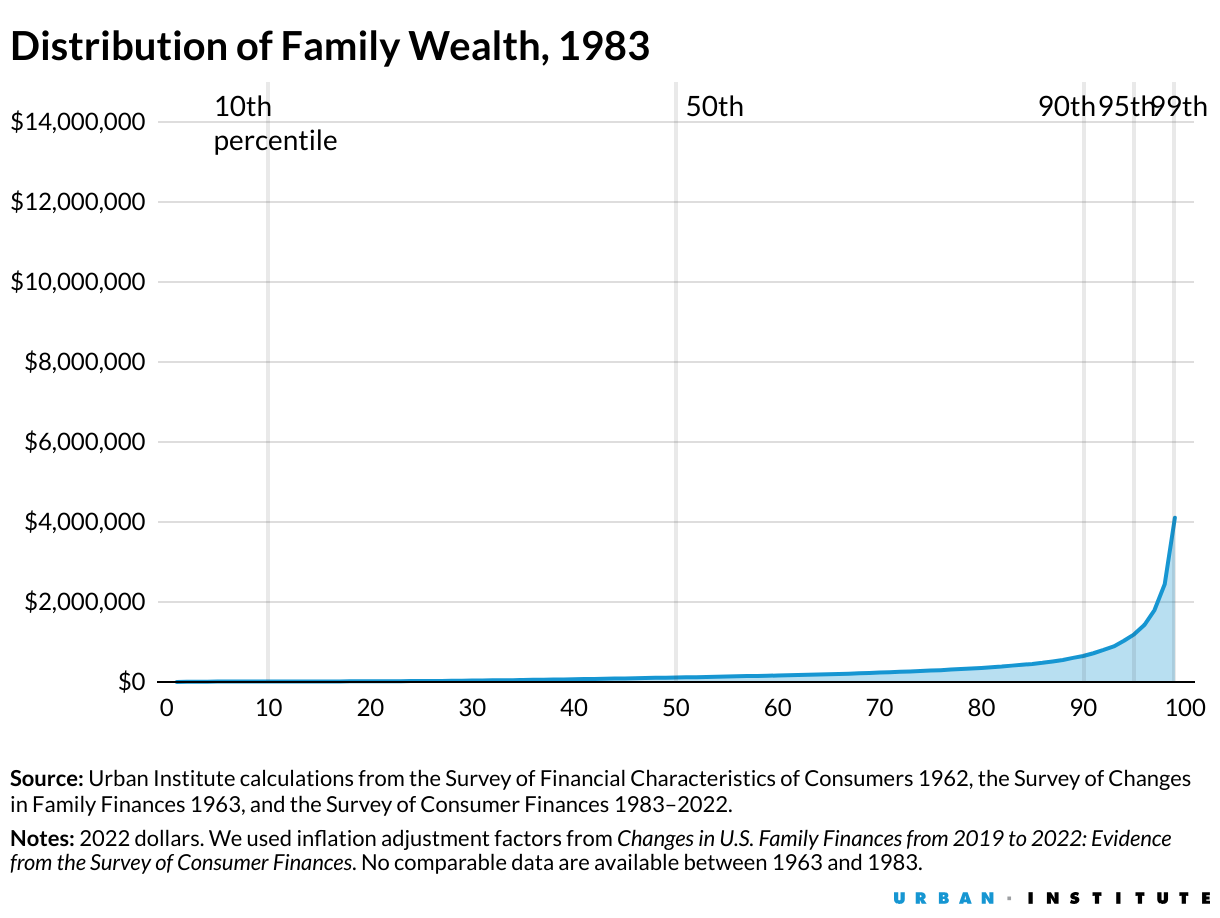

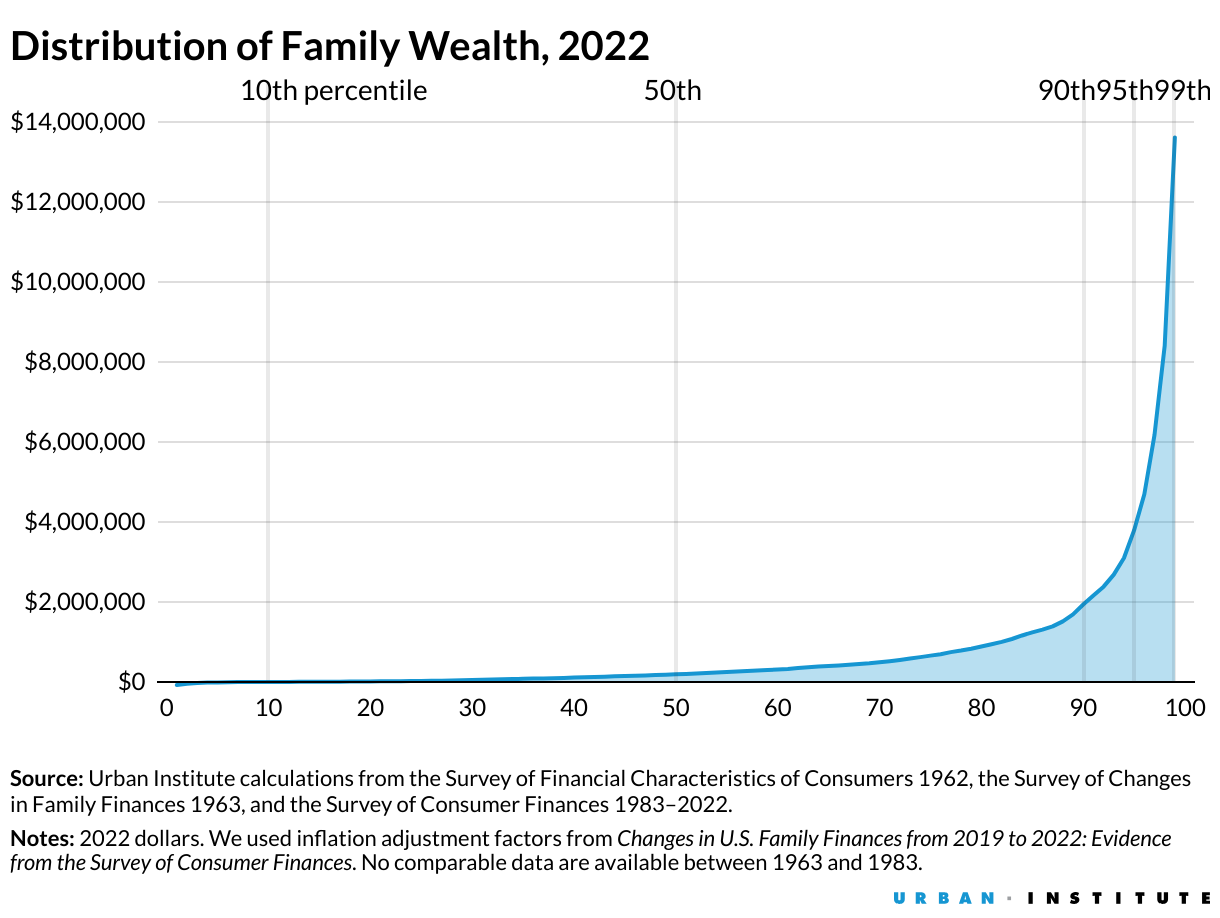

One of the main justifications for overhauling Medicare and Social Security is the narrative of fiscal sustainability. Yet, the real story lies in rising inequality. Initially designed to last until 2060, the Social Security trust fund is now projected to be depleted by 2035. This accelerated timeline is not a result of mismanagement but rather the concentration of wealth in the hands of a few.

Since 1980, productivity in the United States has increased dramatically, fueled by technological advancements, globalization, and innovation. However, wages for the average worker have remained essentially flat. This stagnation, coupled with policies that favor capital over labor, has enabled a staggering transfer of wealth—estimated at $50 trillion—from the working and middle classes to the wealthiest individuals and corporations. This systemic income siphoning has exacerbated inequality and starved programs like Social Security of critical funding, as payroll taxes fail to capture a fair share from the massive earnings above the taxable cap.

Payroll taxes that fund Social Security are capped at $168,800 in income, meaning billionaires like Elon Musk pay the same amount as someone earning just above this threshold. Eliminating this cap would ensure the program's solvency for decades. However, resistance from the wealthiest Americans and their political allies has stalled such reforms. The consequences of inaction are dire. If the trust fund is depleted, benefits will be automatically reduced by 17%, creating a financial crisis for millions of retirees. This underscores the situation's urgency and the need for immediate action to protect these vital programs.

The "Cat Food Commission 2.0 ": Backroom Deals and Procedural Tricks

When past Social Security and Medicare reforms were implemented, commissions often played a central role. For example, the Greenspan Commission under Reagan implemented sweeping changes while shielding policymakers from direct accountability. Critics fear that Project 2025 could employ a similar tactic, creating what some call the "Cat Food Commission 2.0."

This approach would involve crafting reforms behind closed doors and presenting them to Congress as a take-it-or-leave-it package. By bypassing public scrutiny, such tactics could impose unpopular changes without the opportunity for meaningful debate or resistance. The stakes could not be higher for middle-income families and public employees who rely heavily on these programs.

The Stakes for Public Employees and the Middle Class

The proposed changes to Social Security and Medicare would disproportionately harm the middle class and public employees. Previous reforms have already excluded many public servants, such as firefighters and teachers, from Social Security, forcing them to rely on alternative and often less stable retirement options. Expanding these exclusions would only deepen inequalities and erode financial security for millions of workers, making the issue urgent and personal for many.

Moreover, the shift from traditional pensions to 401(k)s has left most workers with insufficient retirement savings. For many, Social Security is now the last dependable source of income in retirement. Reducing benefits would push even more seniors into poverty, creating a ripple effect that could destabilize communities and local economies.

The Public Resistance: Why These Ideas Remain Unpopular

Despite repeated efforts to alter Medicare and Social Security, public opposition remains steadfast. These programs are top-rated across political lines and vital to American life. History shows that grassroots resistance can be incredibly effective. During Bush's privatization push, widespread public backlash forced the administration to abandon its plans. This is a testament to the power of collective action. Community organizations, unions, and individual voters mobilized to defend their earned benefits, demonstrating that ordinary Americans can make a difference.

Today, the challenge is to channel that same energy into protecting these programs from the less overt but equally dangerous threats posed by Project 2025. Awareness and advocacy are essential to ensuring that the voices of ordinary Americans are heard over the interests of the wealthy few.

The fight to protect Medicare and Social Security is far from over. As these programs face increasing pressure, staying informed and engaged is more important than ever. Advocacy groups like Social Security Works offer resources and tools to help individuals make their voices heard. Writing to elected officials, attending town halls, and participating in community organizing can significantly shape the political landscape.

Ultimately, the goal must be to defend and strengthen these programs. Proposals to eliminate the payroll tax cap or expand Medicare funding are practical solutions that deserve widespread support. By rallying around these ideas, we can ensure that Medicare and Social Security remain a promise kept—not just for today's retirees but for future generations.

Medicare and Social Security are not entitlements—they are earned benefits. They represent the promise that hard work and contributions will be rewarded with security and dignity in retirement. As political forces seek to reshape these programs, it is up to the public to remain vigilant and demand accountability. Trump's campaign promises and the realities of Project 2025 underscore the importance of scrutinizing political rhetoric and holding leaders to their word.

References:

- Will the 2024 Election of Donald Trump Impact Social Security?

- A Guide to Project 2025

- Mandate For Leadership: Project 2025 The full text

About the Author

Robert Jennings is co-publisher of InnerSelf.com with his wife Marie T Russell. He attended the University of Florida, Southern Technical Institute, and the University of Central Florida with studies in real estate, urban development, finance, architectural engineering, and elementary education. He was a member of the US Marine Corps and The US Army having commanded a field artillery battery in Germany. He worked in real estate finance, construction and development for 25 years before starting InnerSelf.com in 1996.

Robert Jennings is co-publisher of InnerSelf.com with his wife Marie T Russell. He attended the University of Florida, Southern Technical Institute, and the University of Central Florida with studies in real estate, urban development, finance, architectural engineering, and elementary education. He was a member of the US Marine Corps and The US Army having commanded a field artillery battery in Germany. He worked in real estate finance, construction and development for 25 years before starting InnerSelf.com in 1996.

InnerSelf is dedicated to sharing information that allows people to make educated and insightful choices in their personal life, for the good of the commons, and for the well-being of the planet. InnerSelf Magazine is in its 30+year of publication in either print (1984-1995) or online as InnerSelf.com. Please support our work.

Creative Commons 4.0

This article is licensed under a Creative Commons Attribution-Share Alike 4.0 License. Attribute the author Robert Jennings, InnerSelf.com. Link back to the article This article originally appeared on InnerSelf.com

books_healthcare

Article Recap

Medicare and Social Security are critical safety nets for millions of Americans. Despite Trump's assurances, Project 2025 introduces reforms that threaten to privatize and undermine these programs. Historical patterns reveal a consistent push by conservative leaders to weaken public benefits under fiscal pretenses, exacerbating inequality. Rising wealth concentration further imperils these programs’ funding. Public resistance remains key to safeguarding Medicare and Social Security through advocacy and equitable reforms like eliminating the payroll tax cap.