In this Article

- Why is rethinking economic mindsets essential for climate survival?

- How does the historical context of the gold standard impact current economic paradigms?

- What are the limitations of classical economics in addressing climate change?

- How can interest-free bonds provide a solution for sustainable investments?

- What are the challenges and criticisms of moving beyond traditional economic models?

Rethinking Economic Mindsets for Climate Survival

by Robert Jennings, InnerSelf.com

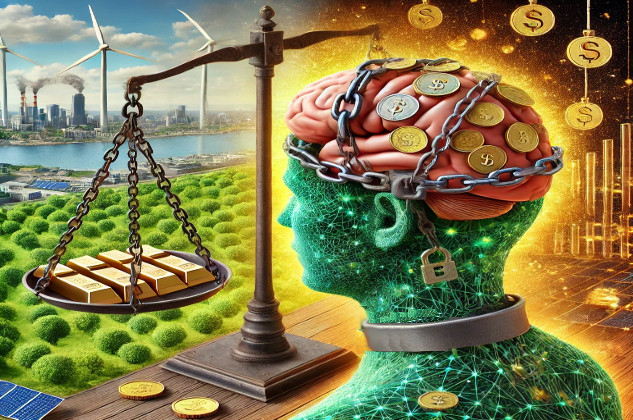

"It is becoming clear that if we can't abolish our mindset-shackles of gold-backed money, we will not survive climate change."

As climate change accelerates alarmingly, it becomes increasingly clear that our current economic paradigms are insufficient for addressing this existential threat. The urgency of this situation demands a radical transformation in how we think about money, resources, and monetary value. This profound quote encapsulates this need: "It is becoming clear that if we can't abolish our mindset-shackles of gold-backed money, we will not survive climate change."

Historical Context and the Gold Standard

Historically, the value of money was tied to a specific amount of gold, a system known as the gold standard. This monetary system provided stability, as the currency's value was directly linked to a tangible asset, thus preventing excessive inflation. However, it also imposed significant constraints on economic growth and flexibility. Because the money supply was limited by the amount of gold available, it restricted governments' ability to respond to financial crises. It limited the capacity for public investment in infrastructure and social programs. The rigidity of the gold standard made it difficult to adapt to changing economic conditions, leading to periods of deflation and financial hardship.

The gold standard was gradually abandoned in the 20th century, with many countries moving away from it during and after the Great Depression. The final nail in the coffin came in 1971 when President Richard Nixon announced that the United States would no longer convert dollars to gold at a fixed value, ending the Bretton Woods system and fully detaching the US dollar from gold.

Despite this shift to fiat currency, where the value of money is not based on physical commodities but on government regulation and economic factors, the mindset associated with gold-backed money lingers. This lingering influence continues to shape economic policies and public perception, fostering a conservative approach to monetary policy and public spending that often emphasizes budgetary constraints over resource availability.

Classical Economics and Its Limitations

Classical economics, rooted in the teachings of Adam Smith, David Ricardo, and other early economic thinkers, emphasizes the importance of land, labor, and capital as the fundamental inputs for production. These foundational elements have shaped economic thought for centuries, forming the bedrock of traditional economic theory. Land represents natural resources, labor encompasses human effort and skills, and capital includes tools, machinery, and infrastructure necessary for production.

This framework has provided a robust structure for understanding how economies function, particularly in producing and distributing goods and services. The principles of classical economics have been instrumental in guiding economic policies and practices, fostering industrial growth, and promoting trade and market efficiencies.

However, this classical framework can be limiting when addressing contemporary challenges such as climate change. The traditional focus on land, labor, and capital often needs to account for the ecological limits and the need for sustainable resource management. Classical economics prioritizes short-term economic gains and market efficiencies over long-term environmental sustainability.

This approach overlooks the finite nature of natural resources and the ecological degradation resulting from unchecked economic activities. Furthermore, classical economics does not adequately address the concept of externalities, such as pollution and climate change, which have significant long-term impacts on the economy and the planet. As a result, there is a growing need to evolve beyond these traditional economic models to incorporate sustainability and ecological balance into financial planning and policy-making.

Beyond the Gold Standard: Interest-Free Bonds

To effectively tackle climate change, we must shift our focus from traditional monetary constraints to available resources. One promising approach is the government's issuance of interest-free bonds. Here's how it works:

The US Treasury can issue interest-free bonds, which the central bank purchases. These bonds are held indefinitely, effectively creating money that can be used for public investment without accruing interest. This method allows for mobilizing significant resources without the burden of debt interest payments. The funds can then be directed toward critical projects such as renewable energy infrastructure, climate adaptation, and mitigation efforts. By removing the interest component, the government can allocate more resources directly to these crucial areas, enhancing our ability to address and mitigate the impacts of climate change.

It's important to note that introducing interest-free bonds does not replace issuing traditional interest-bearing bonds. Interest-bearing bonds serve distinct and valuable purposes in the economy. They provide safe investment options for individuals and institutions, help implement monetary policy, and support various financial markets. On the other hand, interest-free bonds offer a targeted tool to finance urgent public investments in sustainability without the additional interest burden, thereby addressing specific climate change and resource management needs.

This approach is what the Federal Reserve did during the Quantitative Easing (QE) programs initiated in response to the 2008 financial crisis and the COVID-19 pandemic. Through QE, the Federal Reserve purchased large quantities of government securities and other financial assets, injecting liquidity into the economy and lowering interest rates to spur investment and consumption.

By holding these assets, the Federal Reserve effectively increased the money supply. Interest-free bonds build on this concept by creating a dedicated funding mechanism for public climate action and sustainability investments. This ensures that financial resources are available to address these critical challenges without exacerbating national debt burdens through interest accumulation.

Resource-Based Constraints

When we talk about our current limitations, it's not just about money. The real challenges are about the available resources and how we use them. Think of land, labor, and capital as the building blocks of our economy. In today's world, we need to think about these resources differently. Land isn't just a space to build on; it includes all our natural resources like forests, water, and minerals.

We must manage these resources responsibly to ensure they are used efficiently and sustainably. Labor refers to the people who work and their skills, and it's essential to ensure they are healthy and well-educated because a strong workforce is critical to getting things done. Capital is not just money; it includes physical assets like machinery, buildings, and infrastructure, as well as technology and new ideas that drive progress and innovation. Capital is how we distribute money for those things.

Another big part of the puzzle is our ecological limits. This means we have to pay attention to things like how much carbon we're putting into the atmosphere and the health of our ecosystems. The carbon budget is a way to measure how much more carbon dioxide we can release before causing severe damage to the planet.

Biodiversity thresholds refer to the variety of life on Earth, and we need to protect this diversity to keep our environment balanced. So, while managing our finances is essential, it's even more crucial to distribute our natural and human resources wisely. Focusing on the sustainable and fair use of resources can ensure a better and more livable future for everyone.

Policy Implications

Shifting our economic thinking from monetary to resource-based constraints has profound policy implications. By issuing interest-free bonds, governments can fund large-scale projects necessary for transitioning to a sustainable future. Examples include:

Renewable Energy Infrastructure:

Investing in renewable energy infrastructure is crucial for reducing our dependency on fossil fuels and mitigating the impacts of climate change. This involves substantial investments in solar, wind, and other renewable energy sources. Solar energy harnesses the sun's power to generate electricity, which can be used for residential, commercial, and industrial purposes.

Wind energy, captured through wind turbines, provides another sustainable and clean power source. Other renewable sources, such as hydroelectric, geothermal, and biomass, contribute to a diversified and resilient energy mix. Focusing on these renewable technologies reduces greenhouse gas emissions, promotes energy security, creates green jobs, and stimulates economic growth.

Developing renewable energy infrastructure requires coordinated efforts from governments, private sector investments, and community support to build, maintain, and innovate these systems. Transitioning to renewable energy also involves upgrading the existing grid to handle new power sources and ensuring equitable access to clean energy for all communities. Investing in renewable energy infrastructure is critical for a sustainable future, providing long-term environmental, economic, and social benefits.

Climate Adaptation Projects:

Climate adaptation projects are essential for building resilient infrastructure that can withstand the increasingly severe impacts of climate change, such as sea-level rise, extreme weather events, and shifting climate patterns. These projects involve constructing and upgrading buildings, roads, bridges, and other critical infrastructure to make them more durable and resistant to flooding, storms, heat waves, and other climate-related threats.

For instance, coastal areas may require the development of sea walls, levees, and natural barriers like mangroves and wetlands to protect against rising sea levels and storm surges. Urban areas can benefit from improved drainage systems, green roofs, and permeable pavements to manage heavy rainfall and reduce urban heat islands. Rural regions might focus on enhancing agricultural practices to cope with changing weather patterns and preserving natural ecosystems that provide essential services.

These adaptation efforts protect communities and economies and save lives by reducing the risk of catastrophic damage and loss. Practical climate adaptation projects require comprehensive planning, substantial investment, and collaboration between governments, private sectors, and local communities. By prioritizing these projects, we can enhance our resilience to climate change and ensure a safer, more sustainable future for all.

Environmental Restoration:

Environmental restoration is critical to addressing climate change and promoting ecological health by funding reforestation and wetland restoration projects. Reforestation involves planting trees in deforested or degraded areas, which not only helps sequester carbon dioxide from the atmosphere but also restores habitats for wildlife, enhances soil quality, and improves water cycles.

Wetland restoration focuses on rehabilitating and preserving wetlands, which act as natural buffers against floods, store carbon, and provide rich biodiversity hotspots. These projects are vital for maintaining the delicate balance of ecosystems, supporting various plant and animal species, and improving overall environmental resilience. Moreover, restored forests and wetlands offer recreational opportunities, boost local economies through eco-tourism, and provide resources for sustainable livelihoods.

Implementing these projects requires coordinated efforts from governments, non-profits, private sectors, and local communities to ensure long-term success and sustainability. By investing in environmental restoration, we contribute to a healthier planet, mitigate the effects of climate change, and build a more resilient and biodiverse world for future generations.

Challenges and Criticisms

While the concept of interest-free bonds is simple and practical, it is challenging. Critics may argue about the potential inflation risks or the political feasibility of implementing such policies. However, the key lies in effectively managing the creation and allocation of these funds to ensure they are directed toward productive and sustainable uses. Political will and public support are crucial in overcoming these hurdles.

To survive climate change and other pressing societal issues, we must break free from the outdated mindset of gold-backed money. We can develop more effective and sustainable solutions by shifting our focus to natural productive resources and embracing innovative financial tools like interest-free bonds. It is this simple: the barriers are not the complexity of the solutions but the mental constraints we impose on ourselves.

Recognizing and overcoming these constraints can unlock the potential for significant progress. The journey towards this new economic paradigm is challenging. Still, the potential rewards—a sustainable, thriving planet—are well worth the effort. Simply stated we are not restrained by a lack of money but by allocation of resources. During WWII, we met those challenges and can do so again.

"It is becoming clear that if we can't abolish our mindset-shackles of gold-backed money, we will not survive climate change."

Article Recap

This article delves into why rethinking economic mindsets is crucial for climate survival. It explores the historical context of the gold standard and its lingering influence on current economic paradigms. It highlights the limitations of classical economics in addressing climate change, emphasizing the need for sustainable resource management. Innovative financial tools like interest-free bonds are proposed as solutions for funding critical climate projects. The article also addresses potential challenges and criticisms, urging a shift from traditional monetary constraints to resource-based economic planning for a sustainable future.

About the Author

Robert Jennings is co-publisher of InnerSelf.com with his wife Marie T Russell. He attended the University of Florida, Southern Technical Institute, and the University of Central Florida with studies in real estate, urban development, finance, architectural engineering, and elementary education. He was a member of the US Marine Corps and The US Army having commanded a field artillery battery in Germany. He worked in real estate finance, construction and development for 25 years before starting InnerSelf.com in 1996.

Robert Jennings is co-publisher of InnerSelf.com with his wife Marie T Russell. He attended the University of Florida, Southern Technical Institute, and the University of Central Florida with studies in real estate, urban development, finance, architectural engineering, and elementary education. He was a member of the US Marine Corps and The US Army having commanded a field artillery battery in Germany. He worked in real estate finance, construction and development for 25 years before starting InnerSelf.com in 1996.

InnerSelf is dedicated to sharing information that allows people to make educated and insightful choices in their personal life, for the good of the commons, and for the well-being of the planet. InnerSelf Magazine is in its 30+year of publication in either print (1984-1995) or online as InnerSelf.com. Please support our work.

Creative Commons 4.0

This article is licensed under a Creative Commons Attribution-Share Alike 4.0 License. Attribute the author Robert Jennings, InnerSelf.com. Link back to the article This article originally appeared on InnerSelf.com

Recommended Books:

Yellowstone's Wildlife in Transition

Over thirty experts detect worrying signs of a system under strain. They identify three overriding stressors: invasive species, private-sector development of unprotected lands, and a warming climate. Their concluding recommendations will shape the twenty-first-century discussion over how to confront these challenges, not only in American parks but for conservation areas worldwide. Highly readable and fully illustrated.

Over thirty experts detect worrying signs of a system under strain. They identify three overriding stressors: invasive species, private-sector development of unprotected lands, and a warming climate. Their concluding recommendations will shape the twenty-first-century discussion over how to confront these challenges, not only in American parks but for conservation areas worldwide. Highly readable and fully illustrated.

For more info or to order "Yellowstone's Wildlife in Transition" on Amazon.

The Energy Glut: Climate Change and the Politics of Fatness

by Ian Roberts. Expertly tells the story of energy in society, and places 'fatness' next to climate change as manifestations of the same fundamental planetary malaise. This exciting book argues that the pulse of fossil fuel energy not only started the process of catastrophic climate change, but also propelled the average human weight distribution upwards. It offers and appraises for the reader a set of personal and political de-carbonising strategies.

by Ian Roberts. Expertly tells the story of energy in society, and places 'fatness' next to climate change as manifestations of the same fundamental planetary malaise. This exciting book argues that the pulse of fossil fuel energy not only started the process of catastrophic climate change, but also propelled the average human weight distribution upwards. It offers and appraises for the reader a set of personal and political de-carbonising strategies.

For more info or to order "The Energy Glut" on Amazon.

Last Stand: Ted Turner's Quest to Save a Troubled Planet

by Todd Wilkinson and Ted Turner. Entrepreneur and media mogul Ted Turner calls global warming the most dire threat facing humanity, and says that the tycoons of the future will be minted in the development of green, alternative renewable energy. Through Ted Turner's eyes, we consider another way of thinking about the environment, our obligations to help others in need, and the grave challenges threatening the survival of civilization.

by Todd Wilkinson and Ted Turner. Entrepreneur and media mogul Ted Turner calls global warming the most dire threat facing humanity, and says that the tycoons of the future will be minted in the development of green, alternative renewable energy. Through Ted Turner's eyes, we consider another way of thinking about the environment, our obligations to help others in need, and the grave challenges threatening the survival of civilization.

For more info or to order "Last Stand: Ted Turner's Quest..." on Amazon.